We do not supply economic recommendations, advising or brokerage firm services, nor do we recommend or encourage individuals or to get or offer particular supplies or safeties. Performance info may have transformed since the time of publication. Funds from a reverse home loan can influence eligibility for need-based retirement earnings like Medicaid as well as Supplemental Safety Earnings.

Nonetheless, similar to any monetary product, there are many points to consider; there is no one-size-fits-all remedy. Reverse mortgages absolutely satisfy a need in the marketplace, but they are not well-suited for all retired people. It's important to obtain a professional viewpoint on your individual circumstance. Remaining in your house may come to be impractical at some time in retirement if points like climbing the stairs, house upkeep, snow removal and lawn treatment become too much of a problem.

Nevertheless, it's tough to be late on your regular monthly home mortgage payments when such payments are not called for. wesley financial group bbb rating As with any kind of home loan you'll require to continue satisfying your continuous property tax, home owners insurance, and residence upkeep responsibilities. Almost all reverse home loans are guaranteed by the Federal Housing Administration via its Home Equity Conversion Mortgage program. FHA insurance policy guarantees that customers will certainly be able to access their authorized funding funds in the future also if the finance balance surpasses the value of the residence or if the lender experiences economic trouble.

- In 2002, Social Safety wage substitute price was 41 percent for the typical senior citizen at age 65.

- In case of death, your house will be marketed so the reverse home mortgage can be paid back by your estate.

- Depending on a number of variables, including you and your spouse's age as well as the evaluated value of your house, you can borrow up to 55% of the existing worth of your residence.

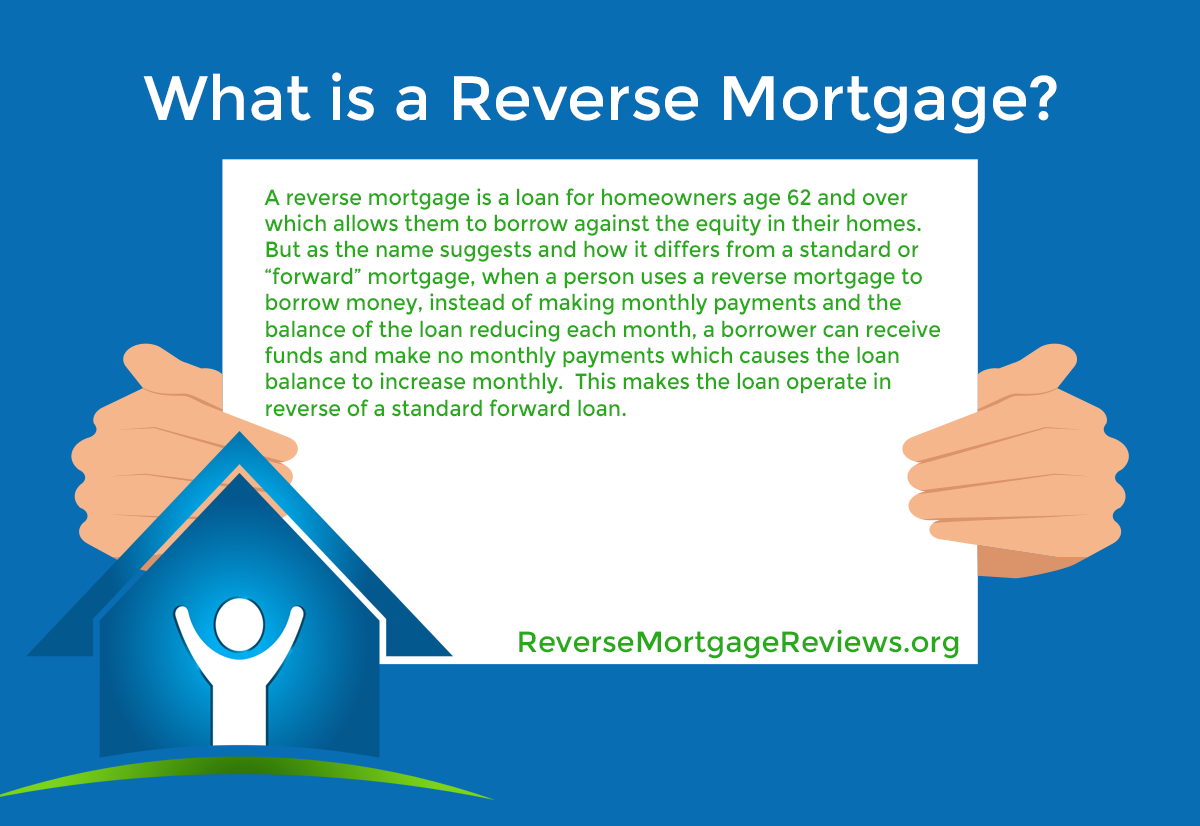

- A reverse mortgage is a finance where you borrow an amount of cash against the worth your building.

- The rate of interest are not constantly desirable, and also you can outlive the worth in your home.

- You can select normal month-to-month payments for as long as you or a co-borrower reside in the house as your main home.

Nonetheless, if your concern is of interest to a vast target market of consumers, the Experian group may include it in a future message and also may likewise share reactions in its social media outreach. If you have a concern, others likely have the same question, too. By sharing your concerns and our solutions, we can aid others also. And your estate won't need to pay more than the worth of your house. The Reverse Home mortgage seems to be the only option to finish his life off in a more comfortable way. This makes a significant distinction even at the identical priced quote rate of interest.

Discover lending supplies with prices and terms that fit your demands. If you move to a nursing home, you'll probably require the equity in your house to pay those prices. In 2016, the average price of a nursing home was $81,128 per year for a semi-private room. A lot of the costs as well as expenses can be rolled into the car loan, which means they compound over time.

What Is A Reverse Mortgage And Exactly How Does It Function?

Lenders are repaid for their losses if the financing end up exceeding the value of your home. The reality that no repayments must be made on a reverse mortgage as long as one house owner remains residing in the house is a significant function of reverse mortgages. However, the fine print listings several situations when the home loan lending institution can seize on the home. The house owner must stay present on property tax as well as insurance settlements.

Pros & Disadvantages Of Reverse Home Loans & Alternatives

The reverse home loan's upfront cost and also 1.25 percent annual insurance fee can be excessive, specifically for those customers selecting the highest possible round figure payment. The in advance premium is a whole lot a lot more expensive than it shows up because it's not based upon the finance quantity however on the home worth (or $625,500, whichever is much less). A 72-year-old customer with a $200,000 residence, as an example, can borrow as much as $118,200, yet the 2.5 percent ahead of time insurance premium of $5,000 is based upon the $200,000 house worth. You could prevent the steep 2.5 percent costs and also lower the insurance coverage expense by selecting a various payout for an ahead of time premium of 0.5 percent, or $1,000. If that weren't uneasy enough, HUD reported that more than 18% of reverse mortgages gotten from 2009 to June 2016 are anticipated to default as a result of unsettled taxes as well as insurance policy.

And also the source charge is based upon the home's value, which is typically much larger than the finance amount. The sector is soaked in pledges, conflict and sign of things to come. If you're considering getting a reverse home mortgage, the best means to make certain a delighted tale is to inform on your own. The very first reverse home loan was created 1961 when Deering Financial Savings & Loan in Portland, Maine, created one to aid a widow stay in her house after her spouse's fatality. As well as because a reverse home mortgage is only letting you use a portion of the worth of your residence anyway, what occurs as soon as you reach that restriction?

Her emphasis gets on debunking debt to aid people and company owner take control of their financial resources. Unless a post is plainly significant "Sponsored", nonetheless, items discussed in content short articles as well as testimonials are based upon the author's subjective assessment of their worth to visitors, not settlement. Our objective at RetireHappy is to existing visitors with reputable economic recommendations and item selections that will aid you achieve your financial objectives. So with that in mind boosting my tiny HELOC, taking on a home loan if possible, or scaling down makes more sense currently. Was taking into consideration a Reverse Mortgage yet after reviewing the cons, I can unconditionally state in no way would certainly I opt for this course of action. After checking out the pros/cons, we are favoring the HELOC, simply wondering what your ideas get on the subject.

Bear in mind that reverse mortgages aren't exclusively meant for single-family homes-- you can also make an application for one if you stay in a condo, so long as it's your key house. A home equity finance funding enables you to obtain as much equity as you require in a round figure with a fixed-rate repayment. House equity finances often come in terms of 5 to 15 years, however you'll need to show you make sufficient income to certify. To determine term and line of credit choices, it's finest to call reverse mortgage loan policemans who have specialized jessica gaynor loan software application to do the computations for you. You can choose regular monthly settlements for as lengthy as you or a co-borrower live in the residence as your main house. The Department of Real Estate and also Urban Development calls for borrowers to total counseling prior wesley group reviews to getting a reverse mortgage, however the complexity of the transaction still leaves lots of seniors confused.